28+ irs audit letter sample 2021

28 IRM 12258 are also empowered to sign notifications under IRC 534b Burden of Proof. Tyranny of FluCovid Related Fake News Stephen Lendman stephenlendman Throughout the USWest the public faces a daily blitzkrieg of fake news about all things flucovid especially about kill shots designed to destroy health on the phony pretext of protecting it.

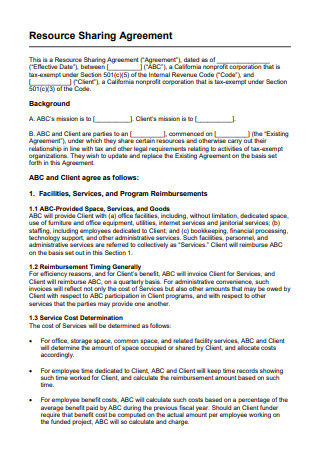

28 Sample Sharing Agreement In Pdf Ms Word

B Numbering 1 FAR provisions and clauses.

. The United States of America has separate federal state and local governments with taxes imposed at each of these levels. The letter is issued before the notice of deficiency unless the statute of limitations is imminent. Our cancellation letter above makes this request for you.

And they are gaining ground fast. Tax audits evaluate the validity of the tax returns your company files. In the past your IRS debt may have appeared on your credit report if the IRS filed a Notice of Federal Tax Lien against you.

At his Wednesday fake news briefing Biden regime flucovid response coordinator Zeffrey Zients. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. 1 formerly DO-4-8 and DO-77 Rev.

Subpart 522 sets forth the text of all FAR provisions and clauses each in its own separate subsection. 2013-22 to reduce the number of employers required to adopt a 403b Pre-approved Plan to permit an application for an advisory letter for a volume submitter specimen plan to be filed by a Mass Submitter on behalf of a minor modifier of the Mass Submitters plan and to extend the deadline for. Starting in 2018 the three major credit bureaus will remove tax liens from consumer credit reports.

If you have not received the confirmation letter within 45 days you can either mail or fax a copy of the original letter to the IRS. Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104. Note that IRS auditors usually schedule and conduct audits randomly and perform it through personal interviews or the mail.

Request confirmation if not received in 45 days. December 28 2021 628 pm Reply to Winston I appreciate your enthusiasm and with more than a passing experience with the courts and more than a typical non lawyers understanding of the law there is a time when I would concur. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of.

Related IRS Notices IRS Letter 566 The IRS Has Selected Your Tax Return For Audit IRS Letter 525 The IRS is Auditing Your Form 1040 and Needs a Response From You IRS Notice CP75 Exam Initial Contact Letter EIC Entire Refund Frozen. However lenders may still search public records for tax liens. The IRS will send a letter confirming their receipt of the updated information within 45 days or less.

Officials delegated to sign notices of deficiency pursuant to Delegation Order 4-8 Rev. Auditors check for inaccuracies in your tax liabilities to verify if your business is either overpaying or underpaying taxes.

Free 10 Disengagement Letter Samples In Pdf Ms Word

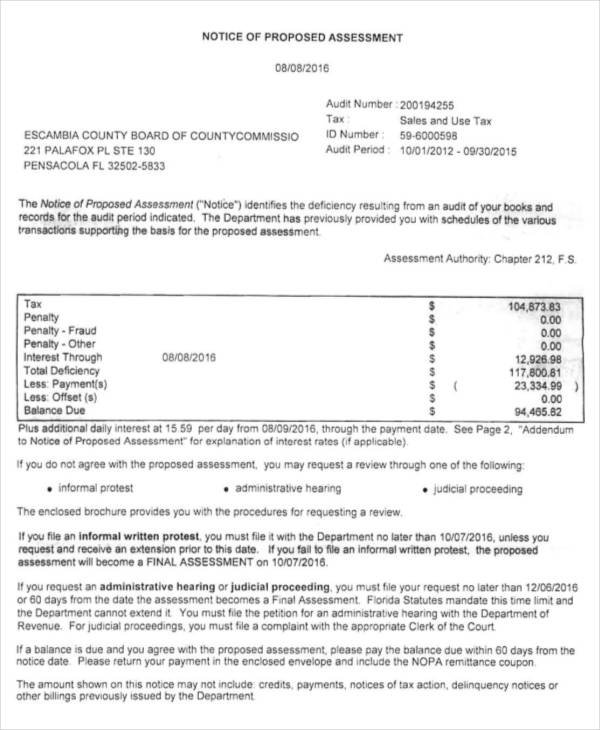

5 Notice Of Assessment Templates Free Samples Examples Format Download Free Premium Templates

Free 10 Disengagement Letter Samples In Pdf Ms Word

Free 10 Disengagement Letter Samples In Pdf Ms Word